Mortgage Broker Association for Beginners

Wiki Article

Some Known Incorrect Statements About Broker Mortgage Meaning

Table of ContentsBroker Mortgage Meaning for DummiesThe Greatest Guide To Mortgage Broker Average SalaryThe smart Trick of Mortgage Broker Salary That Nobody is DiscussingSome Ideas on Mortgage Broker Association You Need To KnowThe Facts About Mortgage Broker Job Description UncoveredTop Guidelines Of Mortgage Broker Vs Loan OfficerThe Best Guide To Broker Mortgage MeaningThe Main Principles Of Mortgage Brokerage

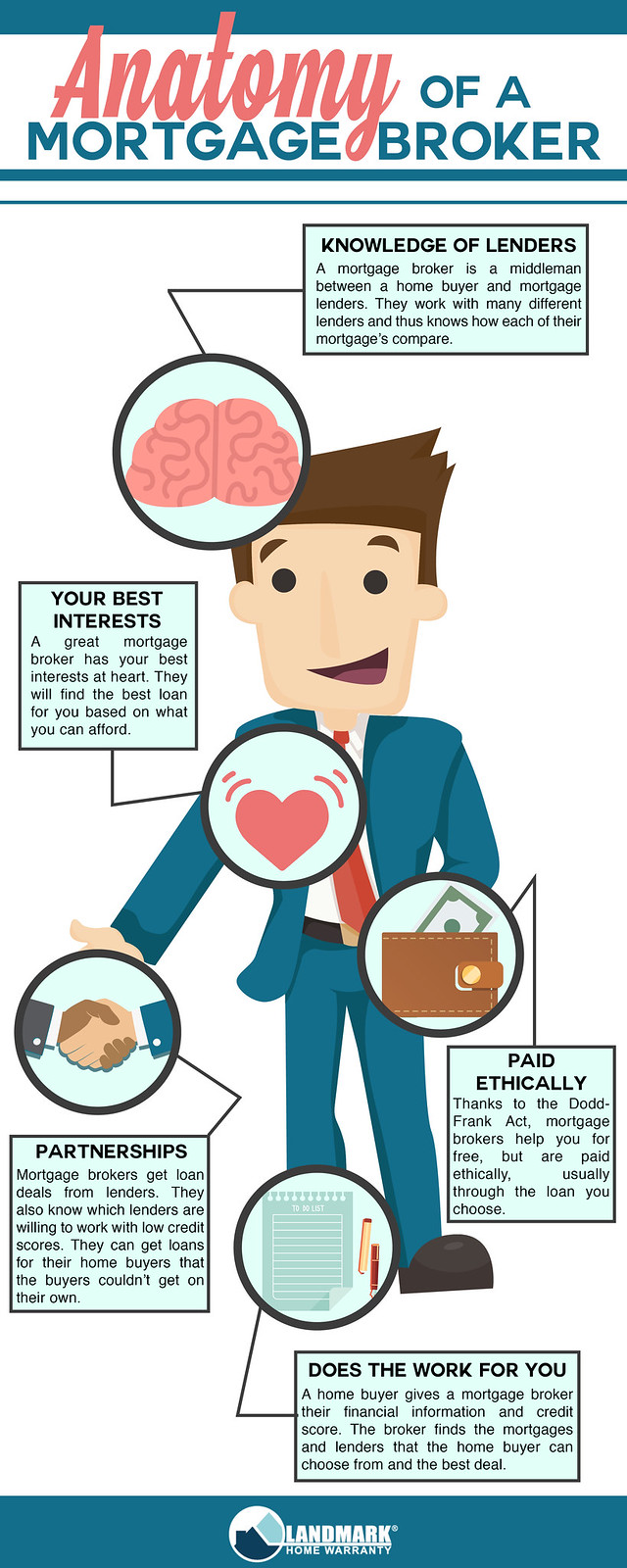

A broker can contrast fundings from a bank as well as a credit history union. According to , her first duty is to the establishment, to make certain fundings are properly protected as well as the debtor is totally certified as well as will certainly make the loan payments.Broker Compensation A home loan broker stands for the consumer more than the loan provider. His obligation is to get the consumer the ideal deal feasible, despite the establishment. He is typically paid by the financing, a kind of compensation, the difference between the rate he gets from the borrowing institution as well as the rate he offers to the borrower.

How Mortgage Broker Association can Save You Time, Stress, and Money.

Jobs Defined Recognizing the pros and also disadvantages of each might assist you make a decision which career path you wish to take. According to, the primary distinction in between both is that the bank home mortgage policeman stands for the items that the bank they benefit offers, while a mortgage broker collaborates with several lending institutions and serves as an intermediary between the loan providers and also customer.On the various other hand, financial institution brokers might find the job mundane after a while since the procedure normally remains the very same.

The Main Principles Of Mortgage Broker Meaning

What Is a Financing Officer? You may recognize that locating a funding policeman is a vital action in the process of obtaining your lending. Allow's review what loan policemans do, what understanding they need to do their job well, as well as whether car loan officers are the most effective alternative for customers in the financing application testing procedure.

Mortgage Broker Assistant Job Description Things To Know Before You Buy

What a Car loan Officer Does, A finance officer benefits a financial institution or independent lending institution to help customers in looking for a car loan. Considering that numerous consumers deal with loan policemans for home mortgages, they are commonly referred to as mortgage police officers, however several funding policemans aid customers with various other fundings as well.A finance officer will consult with you and also review your credit reliability. If a car loan policeman thinks you're qualified, then they'll recommend you for approval, as well as you'll have the ability to advance in the process of getting your finance. 2. What Financing Police Officers Know, Finance policemans have to have the ability to work with consumers as well as little business owners, and they should have substantial expertise regarding the market.

The 10-Minute Rule for Broker Mortgage Meaning

How Much a Funding Policeman Expenses, Some loan policemans are paid through compensations (mortgage brokerage). Mortgage loans tend to result in the biggest commissions since of the dimension and also workload linked with the loan, however payments are frequently a flexible prepaid fee.Loan police officers know all about the lots of types of you could check here fundings a lending institution might offer, as well as they can provide you advice regarding the finest alternative for you and also your situation. Discuss your requirements with your car loan officer.

A Biased View of Broker Mortgage Fees

The Role of a Car Loan Policeman in the Testing Refine, Your lending policeman is your straight call when you're using for a finance. You will not have to stress about regularly calling all the individuals involved in the mortgage funding process, such as the underwriter, genuine estate representative, settlement lawyer as well as others, because your funding policeman will be the factor of call for all of the involved celebrations.Due to the fact that the process of a car loan transaction can be a complicated as well as costly one, several consumers like to function with a human being instead than a computer. This is why banks might have numerous branches they desire to offer the potential borrowers in various areas that want to fulfill in person with a lending policeman.

The Only Guide to Mortgage Brokerage

The Function of a Finance Officer in the Car Loan Application Process, The home loan application process can really feel frustrating, specifically for the newbie homebuyer. When you work with the appropriate loan police officer, find out here the procedure is in fact rather straightforward.During the finance handling stage, your financing police officer will certainly contact you with any type of inquiries the car loan cpus might have about your application. Your funding policeman will then pass the application on to the expert, that will certainly evaluate your creditworthiness. If the expert authorizes your loan, your funding policeman will certainly then collect and prepare the appropriate lending closing papers.

The Single Strategy To Use For Broker Mortgage Calculator

So how do you choose the you could try this out appropriate funding police officer for you? To start your search, start with loan providers who have an outstanding track record for exceeding their consumers' assumptions and maintaining sector criteria. Once you have actually picked a lender, you can then start to tighten down your search by interviewing lending officers you may wish to collaborate with (broker mortgage near me).

Report this wiki page